受歡迎的產(chǎn)品

媒體資訊

更多動(dòng)態(tài)嘉定區(qū)委常委、政法委書(shū)記張勁松蒞臨連成集團(tuán)指導(dǎo)工作

連成 細(xì)雨綿綿,微風(fēng)拂面,2023年1月13日 嘉定區(qū)委常委、政法委書(shū)記張勁松蒞臨上海連成(集團(tuán))有限公司參觀并指導(dǎo)工作。集團(tuán)公司董事長(zhǎng)張錫淼先生熱情的接待了張書(shū)記一行的到來(lái),同時(shí)對(duì)于公司的近況進(jìn)行了詳細(xì)的介紹與講解。

共享RCEP新機(jī)遇丨連成集團(tuán)參展第19屆東博會(huì)

經(jīng)過(guò)一個(gè)多月的準(zhǔn)備,由公司外貿(mào)部牽頭、協(xié)同廣西分公司和大連化工泵廠,代表公司參加的9月16-19日在廣西南寧舉辦的中國(guó)-東盟博覽會(huì)順利完成,收獲很多。

助力低碳, 環(huán)保于心丨第十六屆中國(guó)城鎮(zhèn)水務(wù)發(fā)展國(guó)際研討會(huì)與新技術(shù)設(shè)備博覽會(huì)

2022年9月1日,第十六屆中國(guó)城鎮(zhèn)水務(wù)發(fā)展國(guó)際研討會(huì)與新技術(shù)設(shè)備博覽會(huì)在南京國(guó)際展覽中心盛大開(kāi)幕,第十六屆城市發(fā)展與規(guī)劃大會(huì)同期召開(kāi)。上海連成(集團(tuán))有限公司應(yīng)邀參加了本次大會(huì),將公司的強(qiáng)大實(shí)力以及文化底蘊(yùn)向各界人士進(jìn)行了展示與推廣。

行業(yè)解決方案

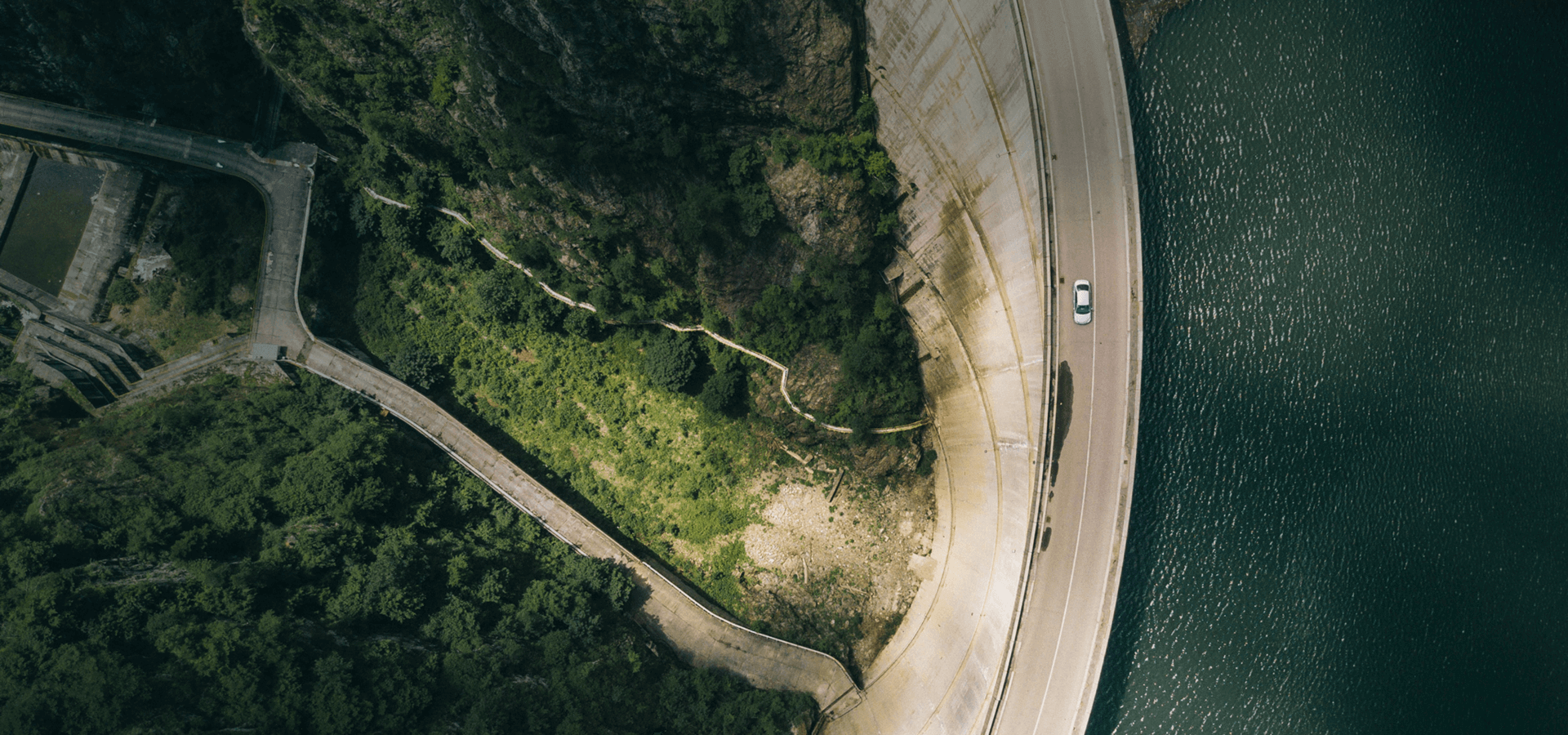

供水行業(yè)

為您創(chuàng)造美好水生活

- 城鎮(zhèn)供水

- 水利灌溉

- 污水處理

- 水利電力

民用行業(yè)

為民生市政工程創(chuàng)造奇跡

- 市政建筑

工業(yè)行業(yè)

加速實(shí)現(xiàn)您的低碳目標(biāo)

- 食品醫(yī)藥

- 石油化工

關(guān)于連成

上海連成(集團(tuán))有限公司創(chuàng)立于1993年,是一家專注于泵、閥、環(huán)保設(shè)備和流體輸送系統(tǒng)、電氣控制系統(tǒng)等研發(fā)和制造的大型集團(tuán)企業(yè)。產(chǎn)品種類涵蓋多系列共五千多種,廣泛應(yīng)用于市政、水利、建筑、消防、電力、環(huán)保、石油、化工、礦業(yè)、醫(yī)藥等國(guó)家支柱領(lǐng)域。

經(jīng)過(guò)二十多年的快速發(fā)展和市場(chǎng)布局,現(xiàn)擁有五大工業(yè)園區(qū),總部設(shè)在上海,分布江蘇、大連和浙江等經(jīng)濟(jì)發(fā)達(dá)地區(qū),總占地面積55萬(wàn)平方米。集團(tuán)產(chǎn)業(yè)有連成蘇州、連成大連化工泵、連成泵業(yè)、連成電機(jī)、連成閥門(mén)、連成物流、連成通用設(shè)備、連成環(huán)境等多家全資子公司、及阿美泰克控股公司。集團(tuán)總資本6.5億,總資產(chǎn)30多億元。2019年集團(tuán)銷售收入達(dá)29.6億元,納稅總額超過(guò)1億元,累計(jì)向社會(huì)捐贈(zèng)超千萬(wàn),銷售業(yè)績(jī)始終保持行業(yè)前茅。

檢測(cè)設(shè)備

2000+

員工

1000+

分公司

500+

分支機(jī)構(gòu)

100+

專業(yè)服務(wù)隊(duì)伍

300+

加入我們

產(chǎn)品選型

產(chǎn)品選型